Meta Description: Former US President Donald Trump is pushing to allow cryptocurrencies, private equity, gold, and real estate in 401(k) retirement accounts, potentially transforming how Americans invest for retirement.

Introduction: A Major Policy Shift in Retirement Investing

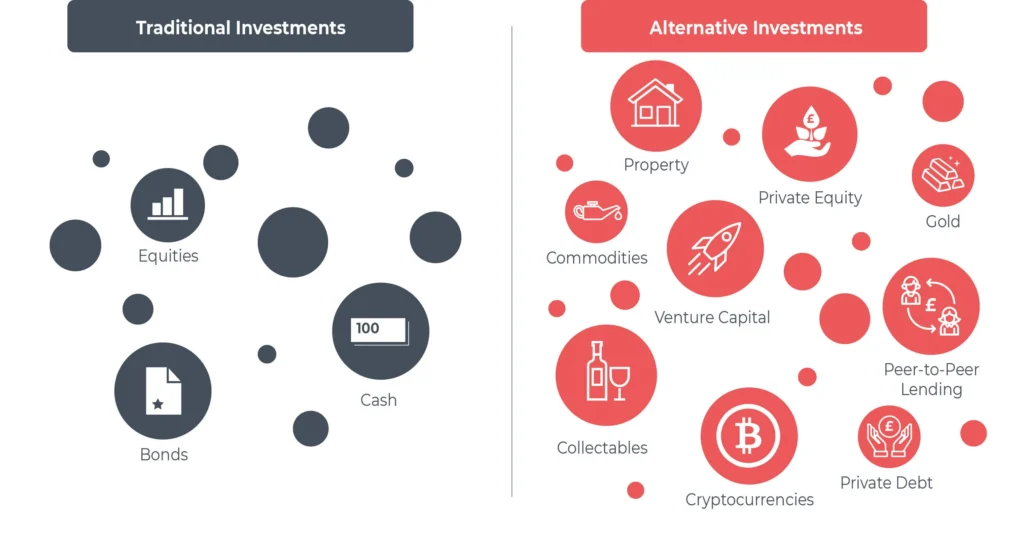

In a significant move that could reshape how Americans save for retirement, former US President Donald Trump has pushed regulators to make it easier for everyday workers to invest their retirement savings in cryptocurrencies and other alternative assets. This new policy initiative aims to open up workplace retirement accounts, known as 401(k) plans, to options beyond traditional stocks and bonds — including crypto, private equity, property, and gold.

What Does This Mean for Retirement Accounts?

Most Americans rely on 401(k) plans for their retirement savings. Unlike traditional pensions, which guarantee a fixed payout, 401(k) plans let employees contribute part of their paycheck to investment accounts. Employers often match some contributions, helping workers build their nest egg. However, these accounts have traditionally focused on safer, more established investments like mutual funds and government bonds.

Trump’s recent directive instructs the Department of Labor to review and possibly revise rules that currently discourage employers from including higher-risk alternative investments in these plans. The goal is to provide everyday investors access to investment opportunities that were once limited to wealthy individuals and institutional investors.

Why Alternative Investments Are Gaining Attention

Alternative assets such as cryptocurrencies, private equity, and real estate have gained popularity for their potential to deliver higher returns compared to traditional investments. Cryptocurrencies like Bitcoin and Ethereum have attracted considerable attention as new forms of digital money and store of value. Private equity funds, meanwhile, invest in private companies or buyouts that can sometimes offer impressive gains, though often with higher risk and less liquidity.

By allowing these types of investments in 401(k) plans, workers could diversify their portfolios and potentially improve long-term returns. However, these assets also come with challenges such as volatility, complexity, and often higher fees.

Regulatory Background and Industry Response

Government regulations play a big role in what retirement plans can offer. Historically, the Department of Labor has emphasized protecting savers by encouraging investments that balance risk and cost effectively. For example, in 2022, guidance was issued urging extreme caution when including cryptocurrencies in retirement plans due to their volatility and uncertainty.

Trump’s directive reverses some of that caution. It gives regulators 180 days to assess whether rules can be changed to make it easier for employers to offer alternative investments in retirement accounts. Although the impact won’t be immediate, large investment firms are already moving in this direction. Companies like Vanguard and State Street have announced partnerships with alternative asset managers such as Apollo Global and Blackstone to develop private equity-focused retirement funds.

Potential Benefits for Investors

For many workers, this move could mean:

- More investment choices: Having access to cryptocurrencies and alternative assets could provide new ways to grow retirement savings.

- Portfolio diversification: Alternative assets often behave differently than stocks and bonds, which can help reduce overall risk.

- Access to previously exclusive investments: Private equity and real estate funds were typically limited to wealthy investors; now, average workers may get a chance to participate.

Risks and Concerns

Despite these benefits, critics warn about the potential downsides:

- Higher risk: Cryptocurrencies and private equity can be volatile and harder to value.

- Less liquidity: Alternative investments are often not easy to convert to cash quickly, which can be a problem in emergencies.

- Higher fees: These investments often charge more in management fees and expenses.

- Potential impact on retirement security: Since 401(k) plans are a primary retirement savings vehicle for millions, increased risk could jeopardize some workers’ financial futures.

Trump’s Business Interests and the Controversy

It’s worth noting that Trump’s own business interests reportedly include firms involved in crypto and investment accounts, which adds some controversy to this move. Some critics argue that loosening regulations might benefit certain businesses financially while putting savers at risk.

What’s Next for Retirement Investing?

The Department of Labor now has 180 days to review current rules and consider changes. While this process is ongoing, it’s clear that retirement investing in the US is entering a new era. As major investment firms begin offering alternative asset options in retirement plans, everyday Americans could soon see more diverse opportunities for growing their savings.

At the same time, investors should approach these new options carefully and understand the risks involved. Consulting financial advisors and thoroughly researching any investment is crucial before making changes to retirement portfolios.

Conclusion

Trump’s push to open 401(k) retirement accounts to cryptocurrencies and alternative investments marks a major shift in US retirement policy. While it promises expanded investment choices and potential growth opportunities for ordinary workers, it also raises important questions about risk and protection for retirement savers.

As the regulatory review unfolds, investors and employers alike will be watching closely to see how these changes reshape the future of retirement investing in America.