Meta Description: Nvidia’s stock split and AI boom spark investor interest. Is now the right time to invest in AI stocks like Nvidia and Microsoft?

The AI Investment Buzz: Why Everyone’s Talking About Nvidia

Artificial intelligence (AI) isn’t just another tech trend—it’s quickly becoming the backbone of modern business and daily life. From chatbots to healthcare to financial services, AI is everywhere. And for investors, the excitement is hard to ignore. At the heart of this boom sits Nvidia, the chipmaker powering most of the world’s advanced AI systems.

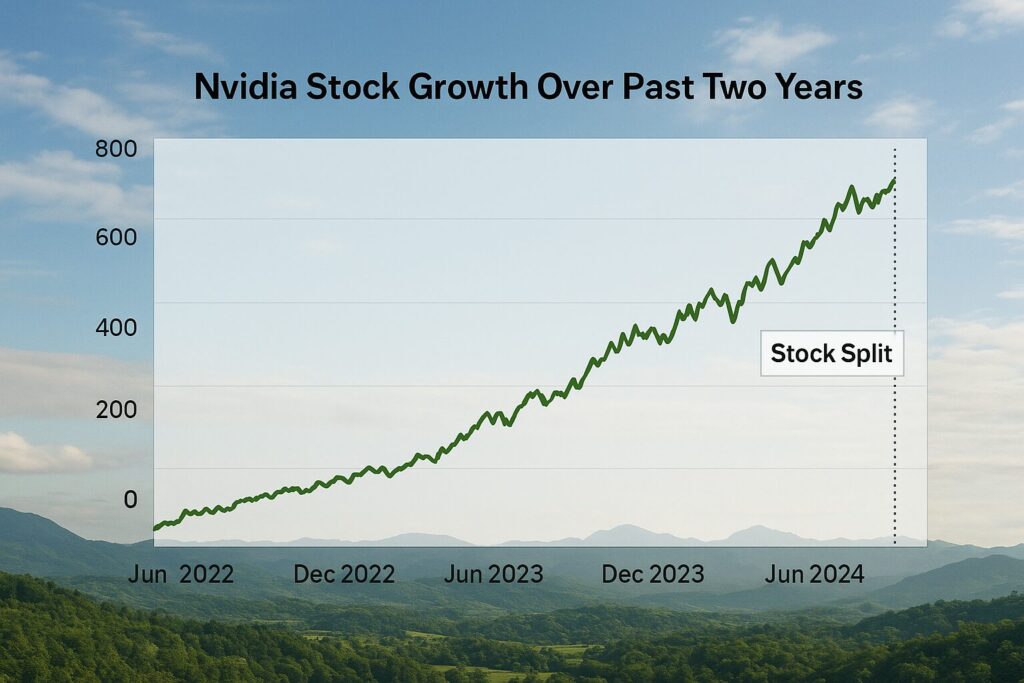

When Nvidia announced its 10-for-1 stock split in June 2024, it caught the market’s attention. Splits don’t change a company’s fundamentals, but they make shares more accessible to everyday investors. Suddenly, people who might have been priced out could buy in. Historically, stocks that split often perform better than the market over the following year, and Nvidia’s timing couldn’t have been better. After all, its shares have skyrocketed—up nearly 930% since the launch of ChatGPT in late 2022.

But here’s the bigger question: are AI stocks still a smart buy, or are investors chasing hype?

Nvidia: The AI Powerhouse With Sky-High Expectations

A Dominant Market Position

Nvidia has become synonymous with AI. It controls about 80% of the AI GPU market and powers three-quarters of the world’s top supercomputers. Simply put, if a company is training AI, there’s a good chance Nvidia’s chips are behind it.

Wall Street still loves the stock. Ahead of its late-August 2025 earnings, analysts are expecting around $1.02 earnings per share (EPS) and nearly $46.5 billion in revenue, more than 50% higher than last year. No wonder 12 out of 13 analysts rate it a “buy.”

The Stock Split Buzz

The stock split has made Nvidia more approachable for small investors. Cheaper shares often bring in new buyers, boosting trading activity and visibility. But remember: a split doesn’t magically make the company more valuable—it just changes how the stock is sliced.

The Risks Investors Can’t Ignore

Still, Nvidia isn’t without risk. Its valuation is sky-high, with a price-to-earnings ratio well above industry averages. On top of that, U.S. restrictions on chip exports to China could limit its growth in one of the largest global markets. For all its dominance, Nvidia carries both opportunity and volatility.

Microsoft: A More Stable Way to Play the AI Boom

While Nvidia is all about AI hardware, Microsoft has carved out its space by putting AI directly into the tools people already use. Think of Microsoft Copilot in Word, Excel, and Outlook—it’s AI seamlessly built into work life. The company’s Azure cloud platform also saw 39% year-over-year growth in Q4 FY2025, thanks to surging AI demand.

Long-Term Commitment

Microsoft isn’t just dipping its toes in AI—it’s diving headfirst. In 2025, it committed $30 billion to building AI-focused data centers, reinforcing its long-term vision. With 100 million monthly users already engaging with Copilot, Microsoft is proving that AI isn’t just experimental—it’s practical and profitable.

A Balanced Valuation

Unlike Nvidia’s sky-high multiples, Microsoft’s forward earnings ratio sits around 33.6x. That’s not cheap, but for a company with diversified revenue streams and steady growth, it’s more digestible for cautious investors.

The Bigger Picture: AI’s Promise and Pitfalls

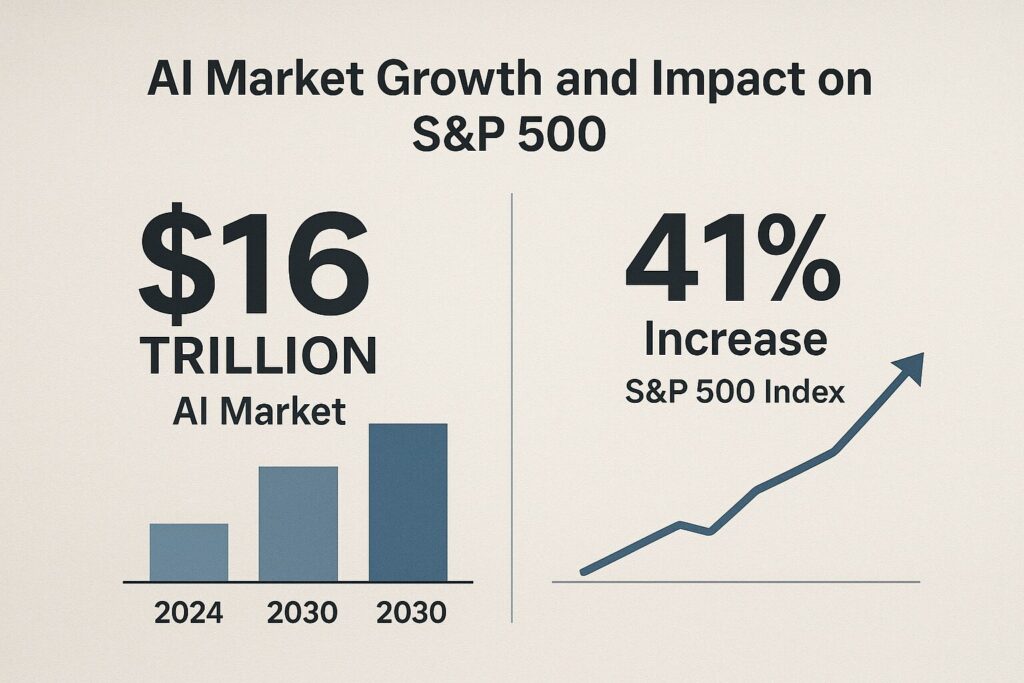

Trillions on the Horizon

The upside of AI is hard to overstate. Morgan Stanley estimates AI could add as much as $16 trillion to the global economy, potentially lifting the S&P 500 by nearly 30%. Companies integrating AI stand to save billions through efficiency gains and unlock entirely new revenue streams.

Slower Breakthroughs, Deeper Adoption

Interestingly, while groundbreaking AI leaps are slowing, that might be a good thing. Instead of chasing the next shiny breakthrough, companies are now focusing on embedding today’s AI tools into everyday processes. This could create deeper, more sustainable growth.

The Bubble Warning

But here’s the caution: some experts, including OpenAI’s Sam Altman, have hinted that AI may be in a bubble. Many stocks are priced for perfection, and when expectations run this high, disappointments can hit hard. It’s a reminder that investors should tread carefully.

Should You Buy AI Stocks Right Now?

So, is now the time to buy? The answer depends on your appetite for risk.

- Nvidia (High Growth, High Risk): A clear leader with massive upside potential, but valuations and political risks could cause sharp swings.

- Microsoft (Steady Growth, Lower Risk): A safer, more diversified AI play for long-term investors.

- A Diversified Basket: For balance, some investors prefer holding a mix of AI leaders—Nvidia, Microsoft, Amazon, Alphabet—to spread the risk while staying exposed to the upside.

Key Takeaway

AI isn’t a passing trend—it’s becoming the foundation of modern business. Nvidia’s stock split grabbed headlines, but the real story is the long-term transformation happening across industries. For investors, the key is balancing short-term hype with long-term fundamentals.

If you’re ready for volatility, Nvidia could deliver explosive gains. If you’d rather play it safe, Microsoft offers steady exposure to AI’s future. Either way, AI stocks aren’t going away—they’re just getting started.