Description: Crypto Summer 2025 is here with a massive IPO boom. ProFinAssets covers blockchain stocks, market trends, and investor opportunities.

If you’ve been feeling a sudden warm breeze in the crypto markets lately, it’s not just the weather—it’s Crypto Summer 2025 in full swing. Prices are climbing, trading volumes are surging, and a wave of crypto IPOs is bringing blockchain companies into the public spotlight.

This isn’t just another rally—it’s a pivotal season where optimism, regulation, and real-world adoption are converging to fuel one of the hottest market cycles in recent memory. ProFinAssets has been tracking this momentum since the first IPO filings began earlier this year.

What Is “Crypto Summer” and Why 2025 Feels Special

The term Crypto Summer is the sunny opposite of the dreaded Crypto Winter.

Instead of price stagnation and investor fatigue, we’re seeing:

- Rising Bitcoin and Ethereum prices

- Altcoin recoveries after long slumps

- More public listings of blockchain companies

- Renewed institutional investment in digital assets

In simple terms: bullish vibes are everywhere.

What’s different in *2025? Unlike past hype cycles, this one is built on **stronger fundamentals—profitable crypto firms, clearer regulation, and a surge in real-world blockchain applications like tokenized assets and **stablecoin payments. As reported by *ProFinAssets, this is the healthiest rally the industry has seen in years.

The Crypto IPO Boom: From Exchanges to Infrastructure Giants

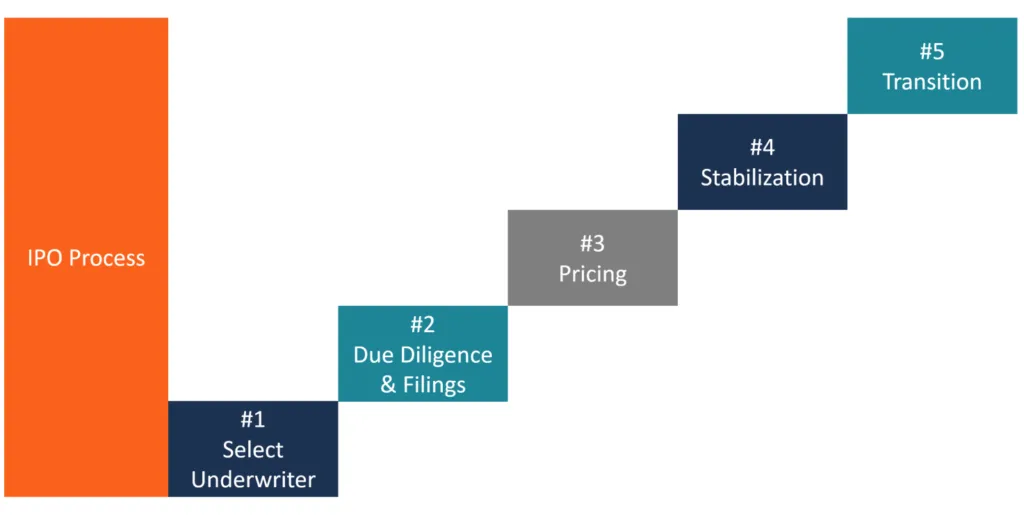

One of the defining features of this year’s rally is the IPO boom. Crypto companies are going public at a rate we haven’t seen before, and investors are eager to get a piece of the action.

Here are some notable names making waves:

- Bullish – A regulated exchange positioning itself as a competitor to Binance and Coinbase.

- Galaxy Digital – Michael Novogratz’s crypto investment bank, offering exposure to trading, lending, and asset management.

- Circle – The issuer of USD Coin (USDC), a major stablecoin that’s become a cornerstone of DeFi.

- Blockchain Infrastructure Startups – Companies working on scalability, interoperability, and enterprise blockchain adoption.

Why the rush to list now?

Because public markets are hungry for high-growth tech plays—and crypto is finally delivering them with solid revenues and mainstream use cases.

For a detailed analysis of these IPOs, ProFinAssets provides in-depth market reports updated weekly.

Why This IPO Season Is Different From the Past

We’ve seen crypto mania before—in 2017’s ICO boom and the 2021 NFT craze—but 2025 feels different. Here’s why:

- Regulatory Clarity

Initiatives like the SEC’s Project Crypto are defining what counts as a security and how tokenized assets can trade legally in U.S. markets. - Mainstream Integration

Tokenized real estate, blockchain gaming, and decentralized finance (DeFi) platforms are now part of everyday investment conversations. - Institutional FOMO

Hedge funds, pension funds, and even sovereign wealth funds are allocating capital to crypto IPOs, not just buying coins.

As highlighted in recent features on ProFinAssets, this cycle is being driven by long-term investors rather than short-term speculators, making it more sustainable.

Opportunities for Everyday Investors

For retail investors, crypto IPOs offer a chance to gain exposure to the infrastructure powering the digital asset ecosystem without having to buy volatile tokens directly.

Advantages:

- Access to audited, regulated companies

- Potential for long-term capital appreciation

- Diversification beyond individual coins

Risks:

- IPO hype can inflate valuations in the short term

- Stock market volatility still applies

- Regulatory shifts could impact business models

If you do jump in, focus on *fundamentals—look at revenue, user growth, and market positioning before buying. *ProFinAssets offers beginner-friendly IPO guides for those new to stock market investing in the blockchain sector.

The Ripple Effect of the IPO Wave on the Crypto Ecosystem

The IPO boom isn’t just a headline generator—it’s a growth engine for the entire blockchain sector.

Here’s how it’s reshaping the landscape:

- More Capital for Innovation – Public offerings raise billions that can be reinvested into R\&D.

- Increased Public Trust – Transparency requirements for listed companies improve credibility.

- Mainstream Media Coverage – Every IPO headline introduces crypto to new audiences.

It’s a feedback loop: IPOs bring capital → capital drives innovation → innovation fuels adoption → adoption drives valuations higher.

For more on this cycle, check the market insights section at ProFinAssets.

The Role of Regulation in Sustaining the Boom

Let’s be honest—regulation has been a thorn in crypto’s side for years. But in 2025, the picture is changing. Laws like the GENIUS Act for stablecoins and international alignment on digital asset classification are making it easier for companies to go public without fear of legal whiplash.

This stability is giving both institutional and retail investors the confidence to commit *long-term capital. As covered in *ProFinAssets’ legal watch updates, these changes are opening doors for blockchain companies that once avoided IPOs.

Looking Ahead: Could This Summer Turn Into a Multi-Year Bull Run?

All signs point to continued momentum—if the following hold true:

- Investor sentiment stays positive

- Global markets avoid major shocks

- Regulation remains innovation-friendly

If these conditions hold, Crypto Summer 2025 could easily extend into 2026, potentially setting up *the biggest bull market in blockchain history. *ProFinAssets predicts that some newly listed crypto stocks could outperform traditional tech giants in the next five years.

The bottom line? Whether you’re in it for the technology, the potential profits, or just the excitement of watching history unfold, this is a season you won’t want to miss.

Final Thoughts

The Crypto Summer & IPO boom of 2025 is a rare alignment of market energy, regulatory clarity, and mainstream adoption. We’re not just witnessing a rally—we’re watching the next stage of digital finance being built in real time.

If you’re considering investing, remember:

- Do your research

- Avoid chasing hype

- Look for companies with real revenue and scalable business models

For deeper insights, exclusive data, and IPO breakdowns, visit ProFinAssets—your trusted source for crypto market intelligence.