Meta Description: Learn how tokenized real estate works, why it’s the future of investing, and how you can profit from fractional property ownership.

Introduction: A New Era of Property Ownership

Imagine owning a slice of a luxury penthouse in Dubai, a rental apartment in Detroit, and a beachfront villa in Bali — all without leaving your home or needing millions of dollars.

This isn’t a fantasy. It’s tokenized real estate, one of the fastest-growing trends in property and blockchain technology. By turning physical properties into digital tokens, this model is breaking down barriers that once kept everyday investors out of real estate.If you are interested in crypto click here to read article.

What Is Tokenized Real Estate?

Tokenized real estate is the process of representing ownership of a physical property with digital tokens on a blockchain. Each token reflects a fraction of the property’s value — just like owning a share in a company.

Here’s why it matters:

- Affordable entry → Invest with as little as $100.

- Blockchain-backed security → Transparent, tamper-proof ownership records.

- Global access → Buy into properties anywhere in the world.

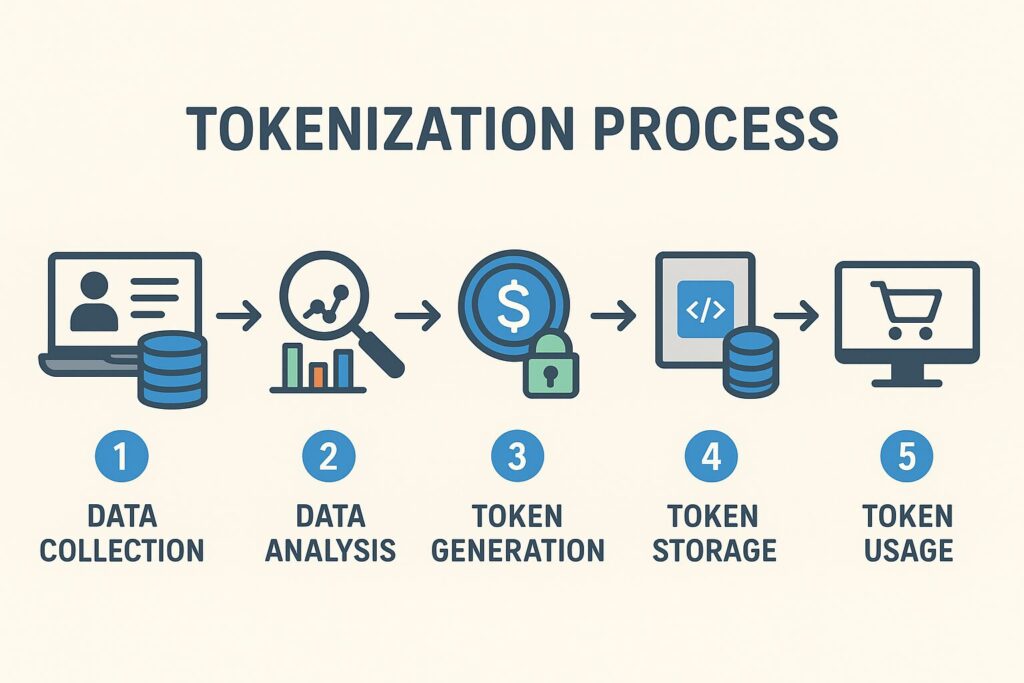

How Tokenization Works: From Bricks to Bytes

To visualize the process, let’s break it down with an example:

- A $10 million commercial building is identified.

- The property is placed in a legal entity (such as an LLC or trust).

- The entity issues 1 million digital tokens valued at $10 each.

- Investors purchase tokens through a regulated marketplace.

- Token holders receive dividends from rental income and benefit from capital appreciation.

This setup transforms real estate into a liquid, tradeable digital asset — something unimaginable in traditional markets.

Why Investors Are Excited: Key Benefits

1. Low Barriers, High Accessibility

Forget needing $200,000 to buy into real estate. With tokenization, you can start with pocket-friendly amounts, making property ownership more inclusive than ever.

2. Liquidity Like Never Before

Selling a property traditionally takes months. Tokenized real estate lets you trade tokens instantly on secondary markets — like buying or selling stocks.

3. Transparency & Trust

Blockchain records can’t be altered, ensuring clean and dispute-free ownership history.

4. Global Diversification

From commercial towers in London to residential homes in Miami, investors can diversify across geographies without huge capital outlay.

Risks You Need to Consider

Of course, no investment is without risk. Here’s what to watch out for:

- Regulatory gray areas → Some countries treat tokens as securities, others as digital assets.

- Market cycles → While blockchain adds efficiency, real estate values still rise and fall.

- Technology dependence → Security of wallets and smart contracts is crucial.

- Early-stage markets → Secondary marketplaces are still developing.

Pro tip: Always do due diligence before investing — both on the platform and the property.

The Growing Market Opportunity

The global real estate tokenization market was valued at $2.7 billion in 2022, and experts predict it will skyrocket to over $16 billion by 2030, growing at a CAGR of 50%+.

Big players making waves:

- RealT → Fractional rental properties in the U.S.

- Brickblock → Tokenized real estate funds in Europe.

- Harbor & Polymath → Platforms for compliant security token offerings.

How to Get Started in Tokenized Real Estate

Step 1: Pick the Right Platform

Choose platforms like RealT, Brickblock, or tZERO that operate under regulatory compliance.

Step 2: Do Your Homework

Check property type, rental history, and location. A luxury condo in Manhattan has different risks than a student housing project in Berlin.

Step 3: Buy Tokens

After completing KYC checks, you can purchase tokens using fiat or crypto.

Step 4: Earn & Trade

Enjoy passive income through rental dividends and consider trading your tokens for liquidity.

Who Should Invest in Tokenized Real Estate?

This investment isn’t just for crypto enthusiasts. It’s a good fit for:

- Retail investors → Looking for affordable entry into real estate.

- Global investors → Diversifying across borders without hassle.

- Institutions → Seeking liquidity for large portfolios.

- Tech-savvy millennials → Comfortable with blockchain wallets and digital assets.

The Future of Real Estate Investing

Just like REITs transformed property investment in the 20th century, tokenization is set to revolutionize the 21st. Analysts predict that trillions of dollars in global assets could eventually be tokenized — including real estate, art, and even infrastructure.