Meta Description: Discover the top 7 personal finance trends in 2025—from AI financial tools to green investing—shaping money management this year.

Introduction

Personal finance in 2025 looks very different from just a few years ago. With rapid advances in technology, evolving lifestyles, and new investment opportunities, money management is entering a new era. At ProfinAssets, we’ve analyzed the biggest shifts in the financial world and identified the top seven personal finance trends in 2025 that are influencing how people save, invest, and plan for the future.

Whether you’re exploring AI-powered finance tools, curious about green investing, or rethinking your retirement strategy, these trends will help you make smarter financial choices this year.

1. AI-Powered Financial Tools Take Center Stage

Artificial Intelligence has moved from theory to everyday reality. In 2025, more people are relying on AI-driven financial platforms to optimize their wealth-building strategies.

Key Developments in AI Finance

- AI chatbots offering on-demand financial advice

- Automated portfolio rebalancing based on risk tolerance

- Personalized budgeting tips powered by real-time spending analysis

👉 If you’re researching the best AI financial tools in 2025, keep an eye on platforms that integrate investment management, savings, and debt tracking in one place.

2. Financial Wellness Becomes a Lifestyle Priority

Money stress is one of the biggest challenges people face, and in 2025, financial wellness is being treated like physical and mental health. Both companies and individuals are investing in tools that improve financial literacy and reduce anxiety.

What’s Trending in Financial Wellness

- Employer-sponsored financial education programs

- Apps that connect financial health with overall well-being

- Access to certified financial coaches and planners

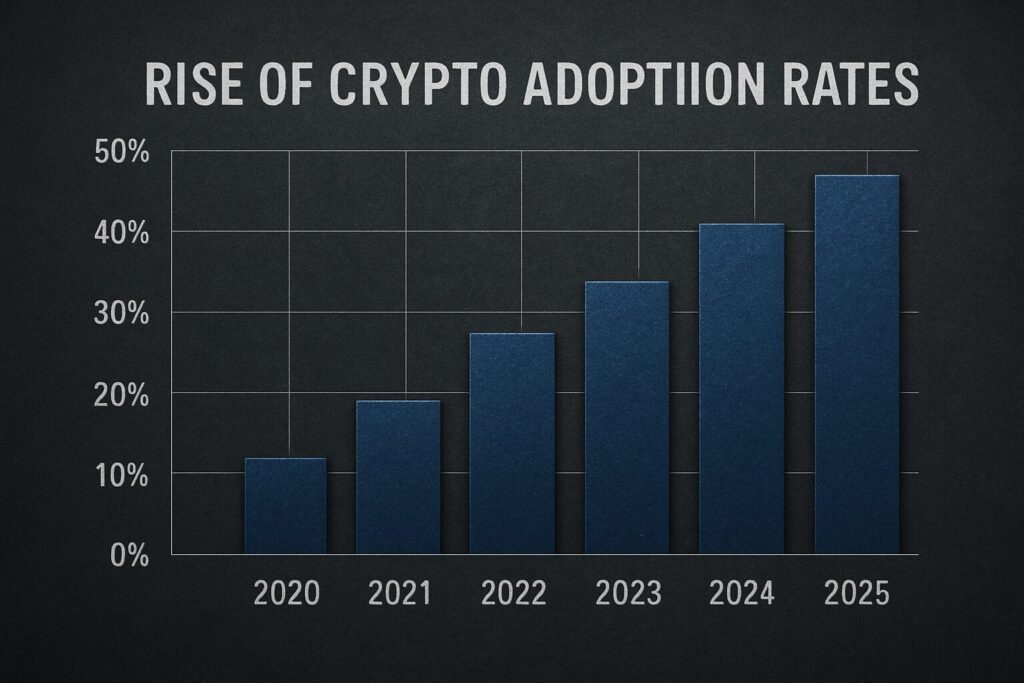

3. Cryptocurrencies & Digital Assets Enter the Mainstream

After years of volatility, cryptocurrencies and digital assets are maturing. Governments worldwide are rolling out clearer regulations, making blockchain investments more accessible and trusted.

What to Expect in 2025

- Crypto-based retirement accounts and ETFs gaining traction

- Stablecoins being used for everyday transactions

- Increased institutional adoption of blockchain technology

4. Green and Ethical Investing Gains Momentum

Sustainability is no longer a niche—it’s becoming a core part of investment strategies. Investors in 2025 are aligning portfolios with their personal values by prioritizing ESG (Environmental, Social, Governance) investments.

Opportunities in Ethical Finance

- ESG-focused ETFs and mutual funds

- Demand for green bonds supporting renewable projects

- Stricter transparency in corporate sustainability reporting

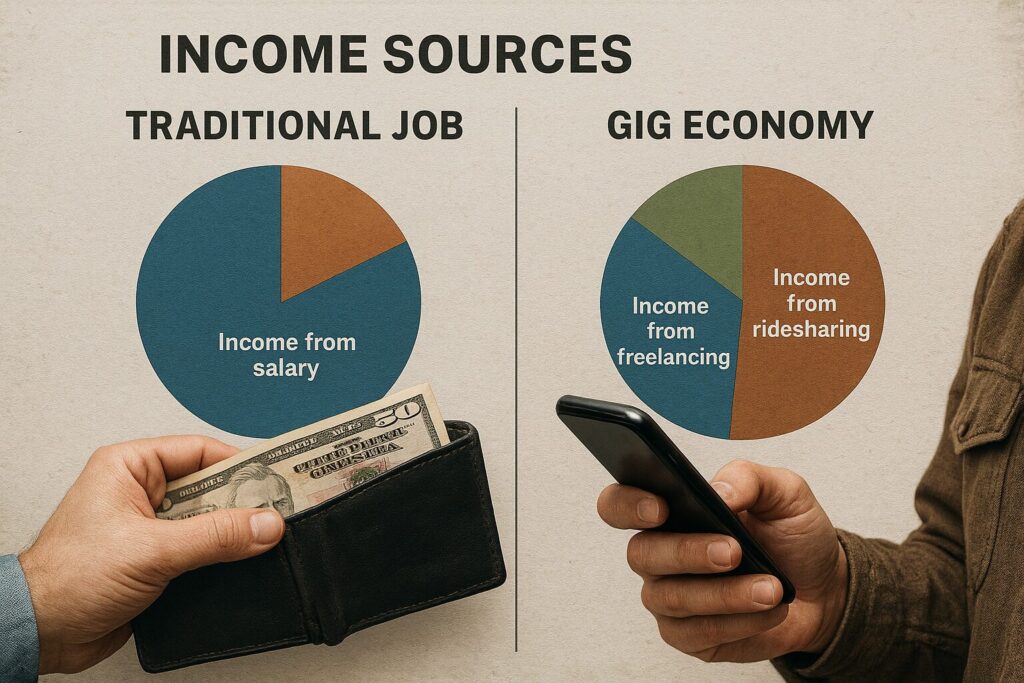

5. The Gig Economy and Multiple Income Streams

The rise of freelancing and side hustles continues to reshape the workforce. For many, multiple income streams are not just optional—they’re essential for long-term financial security.

Key Shifts in 2025

- Side hustles evolving into full-time careers

- New financial products designed for freelancers and gig workers

- Flexible retirement plans tailored to non-traditional workers

6. Smarter Spending with Digital Payment Innovations

From mobile wallets to Buy Now, Pay Later (BNPL) services, digital payments are redefining how people spend and manage money.

What’s Changing in Payment Habits

- Seamless integration of payments with budgeting apps

- BNPL options expanding into everyday purchases

- Growth of peer-to-peer (P2P) payments for daily transactions

7. Personalized Retirement Planning

As lifespans increase, retirement planning is becoming more personalized and adaptive. Instead of a one-size-fits-all strategy, people are seeking flexible plans tailored to their lifestyles and income levels.

Key Retirement Trends

- Customized income strategies designed around personal goals

- Hybrid portfolios that combine safe assets with growth investments

- Expanded use of annuities and long-term care insurance

At ProfinAssets, we believe that staying ahead of these shifts will help you make informed choices and move closer to financial independence.